Irs Business Gift Limit 2024 Chart – Understanding the gift tax and its limits is crucial when planning your financial gifts, whether for family, friends or others. The IRS sets specific guidelines each year for how much you can . It’s nobler to give than to take, the saying goes, and giving assets to loved ones while you’re still alive is a great way for them to enjoy the benefits right away — and for you to delight in .

Irs Business Gift Limit 2024 Chart

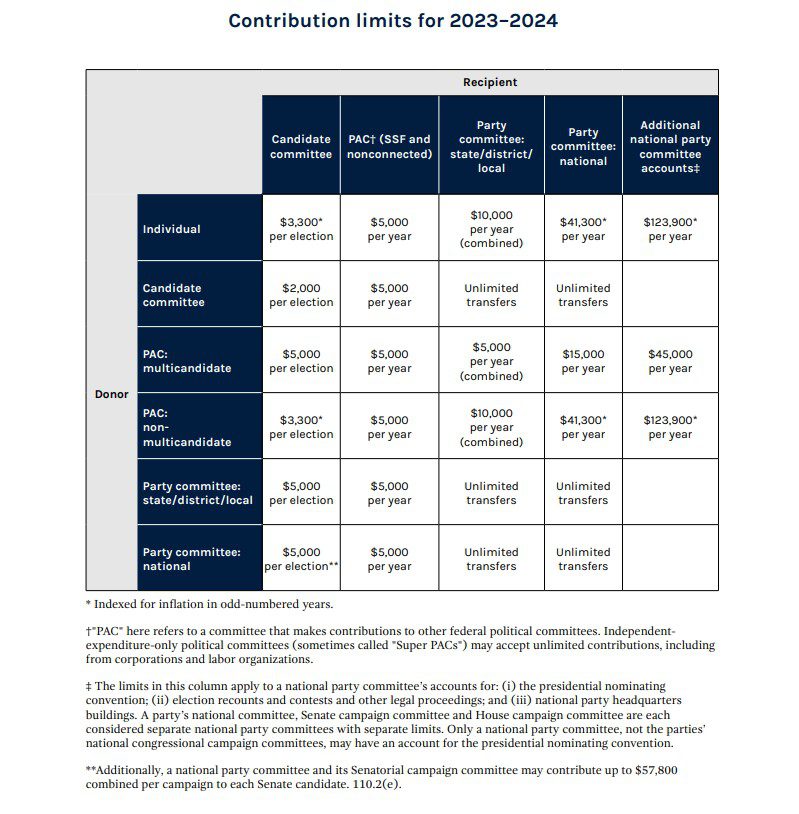

Source : www.forbes.com2023 Inflation Adjustments and FEC Contribution Limits Harmon Curran

Source : harmoncurran.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgWhen To Expect My Tax Refund? IRS Refund Calendar 2024

Source : thecollegeinvestor.comKey 2024 Tax Changes Wilke CPAs & Advisors

Source : wilkecpa.comPublication 505 (2023), Tax Withholding and Estimated Tax

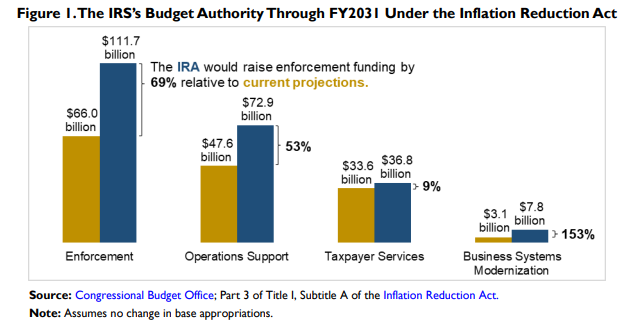

Source : www.irs.gov2024 Tax Policy Outlook The S Corporation Association

Source : s-corp.orgPublication 463 (2023), Travel, Gift, and Car Expenses | Internal

Source : www.irs.govProjected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comIrs Business Gift Limit 2024 Chart IRS Announces 2024 Tax Brackets, Standard Deductions And Other : It is a transfer tax, not an income tax. Ordinary monetary and property gifts are unlikely to be impacted by this tax, since the yearly limit for 2024 is $18,000 per giver per recipient. When you . For 2024, the standard tax deduction for single filers has been raised to $14,600, a $750 increase from 2023. For those married and filing jointly, the standard deduction has been raised to $29,200, .

]]>